Introduction

When economic uncertainty looms, investors and analysts turn to various forecasting tools to anticipate potential downturns. Among the most closely watched are the recession indicators developed by Hussman Investment Trust, led by economist Dr. John hussman investment trust recession indicators . These sophisticated metrics have garnered attention for their systematic approach to identifying economic vulnerabilities and market risks.

Understanding these indicators can provide valuable insights into economic cycles and help investors make more informed decisions during turbulent times. Whether you’re a seasoned investor or someone seeking to understand economic forecasting better, exploring Hussman’s methodology offers a window into how professional analysts assess recession risks.

Dr. Hussman’s approach combines traditional economic analysis with rigorous statistical methods, creating a framework that has accurately identified several major economic turning points. His recession indicators don’t just look at single metrics but instead examine multiple economic variables to paint a comprehensive picture of economic health.

Understanding Hussman Investment Trust’s Approach

Hussman Investment Trust, founded by Dr. John Hussman, operates with a research-driven investment philosophy that emphasizes risk management and market cycle analysis. Dr. Hussman holds a Ph.D. in economics from Stanford University and brings decades of experience in both academic research and practical investment management.

The trust’s recession indicators stem from Dr. Hussman’s belief that economic downturns follow predictable patterns that can be identified through careful analysis of leading economic indicators. Rather than relying on gut feelings or single data points, Hussman’s methodology employs a systematic approach that examines multiple economic variables simultaneously.

This comprehensive framework considers everything from employment trends and consumer spending patterns to credit conditions and market valuations. The goal isn’t just to predict when a recession might occur, but to understand the underlying economic forces that drive these cycles.

Key Recession Indicators Used by Hussman

Employment and Labor Market Signals

Hussman pays particular attention to employment trends, recognizing that labor market changes often precede broader economic shifts. The indicators examine not just unemployment rates but also employment-to-population ratios, initial jobless claims trends, and the quality of job growth across different sectors.

These employment metrics serve as early warning signals because businesses typically adjust their workforce before making other significant operational changes. By monitoring these patterns, Hussman’s indicators can detect economic stress before it becomes apparent in other economic measures.

Credit and Financial Conditions

Credit markets play a crucial role in Hussman’s recession indicators. The analysis examines corporate credit spreads, which measure the difference between corporate bond yields and Treasury bond yields. Widening spreads often signal increasing investor concern about corporate default risk.

Additionally, the indicators monitor lending standards, credit growth rates, and the overall availability of credit in the economy. When credit conditions tighten significantly, it often foreshadows economic contraction as businesses and consumers find it more difficult to finance spending and investment.

Market Valuation and Sentiment Measures

Stock market valuations form another pillar of Hussman’s recession indicators. The analysis goes beyond simple price-to-earnings ratios to examine more comprehensive valuation measures that account for profit margins, growth expectations, and historical norms.

Market sentiment indicators also play a role, measuring investor confidence and risk appetite. Extreme readings in either direction—excessive optimism or widespread pessimism—can signal potential turning points in economic cycles.

Economic Growth and Productivity Trends

Hussman’s indicators closely monitor various measures of economic output and productivity growth. These include gross domestic product trends, industrial production, and measures of economic efficiency across different sectors.

The analysis looks for divergences between different economic sectors and regions, as well as changes in the underlying drivers of economic growth. Declining productivity growth or weakening output trends can signal developing economic weaknesses.

Current Economic Assessment Using Hussman’s Framework

Applying Hussman’s recession indicators to current economic conditions requires examining each component of the analytical framework. Recent labor market data shows mixed signals, with strong headline employment numbers but concerns about job quality and wage growth sustainability.

Credit conditions present another area of focus. While credit remains relatively available, there are signs of tightening in certain sectors, particularly commercial real estate and some consumer credit categories. Corporate credit spreads have shown periodic volatility, reflecting changing investor sentiment about business prospects.

Market valuations according to Hussman’s measures remain elevated by historical standards, though they’ve shown significant variation across different sectors and market segments. This creates a complex environment where some areas appear overvalued while others may offer better risk-adjusted opportunities.

Economic growth indicators show resilience in some areas while revealing vulnerabilities in others. Consumer spending remains relatively stable, but business investment and manufacturing activity have shown signs of slowing in certain periods.

Historical Track Record of Hussman’s Predictions

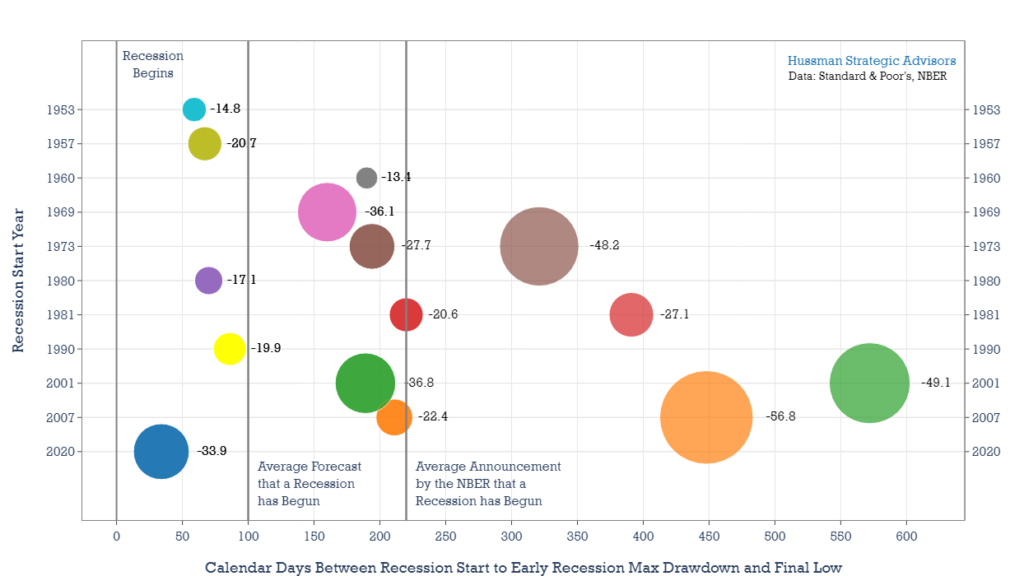

Hussman’s recession indicators gained significant attention for correctly identifying conditions preceding the 2000-2002 recession and the 2007-2009 financial crisis. The indicators signaled developing vulnerabilities well before these downturns became apparent to many other analysts.

During the late 1990s technology boom, Hussman’s indicators warned of unsustainable market valuations and economic imbalances. While the timing of the eventual correction was difficult to predict precisely, the indicators successfully identified the fundamental weaknesses that eventually led to the recession.

Similarly, in the mid-2000s, hussman investment trust recession indicatorsanalysis highlighted growing risks in credit markets and housing-related sectors. The indicators detected the building financial imbalances that ultimately contributed to the 2007-2009 financial crisis.

However, like all forecasting tools, Hussman’s indicators have also produced some false signals and timing challenges. The complex nature of modern economies means that even well-designed indicators can struggle with the precise timing of economic turning points.

Limitations and Considerations

While Hussman’s recession indicators offer valuable insights, they’re not infallible predictive tools. Economic forecasting involves inherent uncertainties, and multiple factors can influence the timing and severity of economic cycles.

The indicators work best when viewed as risk assessment tools rather than precise timing mechanisms. They help identify periods of elevated recession risk rather than pinpointing exact dates when downturns will begin.

Additionally, policy interventions by governments and central banks can alter the typical patterns that recession indicators rely upon. Unprecedented monetary and fiscal policies can sometimes delay or modify the economic adjustments that indicators suggest are likely.

Frequently Asked Questions

How often are Hussman’s recession indicators updated?

Hussman regularly updates his economic analysis through weekly research reports and market commentaries. The underlying data for the recession indicators is typically updated monthly or quarterly, depending on the release schedule of various economic statistics.

Do the indicators work for predicting the severity of recessions?

While the indicators are primarily designed to identify recession risk rather than severity, they can provide insights into the underlying economic vulnerabilities that might influence how deep or prolonged a downturn becomes.

How do Hussman’s indicators compare to other recession forecasting tools?

Hussman’s approach is more comprehensive than single-indicator models but shares similarities with other multi-factor economic forecasting frameworks. The key difference lies in the specific combination of variables and the statistical methods used to analyze them.

Can individual investors effectively use these indicators?

While the full analytical framework requires sophisticated economic knowledge, individual investors can benefit from understanding the key concepts and incorporating similar risk assessment principles into their own investment decision-making.

Making Sense of Economic Forecasting

Hussman Investment Trust’s recession indicators represent one valuable approach to understanding economic cycles and assessing recession risk. While no forecasting tool offers perfect accuracy, the systematic methodology and historical track record make these indicators worth considering as part of a broader economic analysis framework.

The key lesson from Hussman’s approach is the importance of looking beyond single economic metrics to examine the complex interplay of factors that drive economic cycles. By understanding these relationships, investors and analysts can better prepare for the inevitable ups and downs of economic life.

Rather than seeking perfect predictions, the goal should be developing a more nuanced understanding of economic risks and opportunities. This perspective can lead to better long-term investment decisions and more realistic expectations about market behavior during different economic environments.