Introduction

Technical analysis offers traders a powerful lens to view market movements, helping them identify potential opportunities based on historical price action. Among the various chart patterns available, the ABC pattern stands out for its simplicity and effectiveness. This pattern, a fundamental building block of Elliott Wave Theory, helps traders anticipate market corrections and continuations.

This guide will explore a specific variation of the ABC pattern: the one defined by the .328 and 1.27 Fibonacci ratios. Understanding this particular setup can provide a clearer framework for making trading decisions. We will cover how to identify this pattern, develop effective trading strategies around it, manage associated risks, and apply it to real-world scenarios. By the end, you’ll have a practical understanding of how to integrate the ABC .328 1.27 pattern into your trading toolkit.

What is the ABC Pattern?

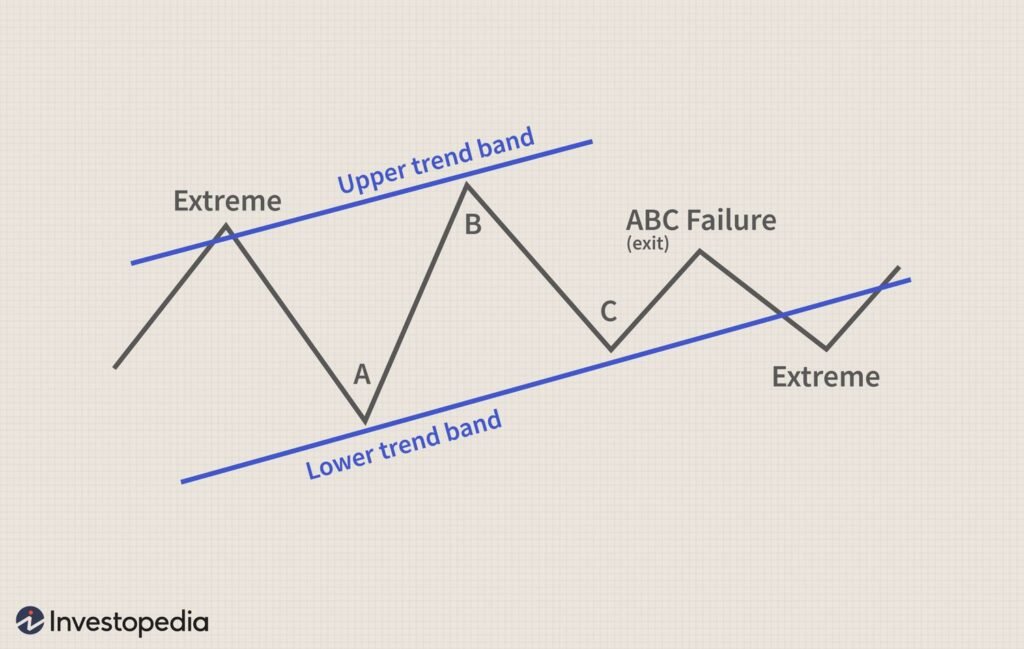

The ABC pattern is a three-wave corrective price movement that moves against the primary market trend. It’s a common formation that signals a temporary pause or correction before the main trend resumes. The pattern is composed of three distinct legs, labeled A, B, and C:

- Wave A: The initial move against the primary trend.

- Wave B: A partial retracement of Wave A, moving back in the direction of the primary trend.

- Wave C: The final leg, moving in the same direction as Wave A and typically extending beyond its endpoint.

Traders use Fibonacci ratios to measure the relationships between these waves, which helps in predicting the potential end points of the correction and identifying entry or exit points.

Understanding the .328 and 1.27 Ratios

Fibonacci ratios are mathematical relationships derived from the Fibonacci sequence, and they are widely used in financial markets to identify key levels of support and resistance. In the context of the ABC pattern, two specific ratios are crucial for this particular setup: 0.382 (often rounded to .328 in some trading circles, though 0.382 is the standard) and 1.272 (often rounded to 1.27).

- The 0.382 Ratio (Point B): This ratio helps define the retracement of Wave A. After the initial impulse of Wave A, the price corrects back in the direction of the original trend. In this specific pattern variation, Wave B retraces approximately 38.2% of the length of Wave A. This is a relatively shallow retracement, suggesting that the corrective momentum is strong.

- The 1.272 Ratio (Point C): This ratio is a Fibonacci extension used to project the target for Wave C. After Wave B completes its retracement, Wave C begins, moving in the same direction as Wave A. The 1.272 extension projects that Wave C will be approximately 1.272 times the length of Wave A. This extension beyond the end of Wave A indicates a strong corrective move.

When these two ratios align, they form the specific ABC .328 1.27 pattern, giving traders a well-defined structure to anticipate market behavior.

How to Identify ABC Patterns on a Chart

Identifying the ABC .328 1.27 pattern requires a systematic approach using your charting platform’s Fibonacci tools.

- Identify the Primary Trend: First, determine the dominant trend on the chart (e.g., an uptrend or a downtrend). The ABC pattern will be a correction against this trend.

- Spot the Initial Corrective Move (Wave A): Look for a clear price movement that goes against the primary trend. This is the first leg, Wave A. Mark its start (the swing high/low) and its end.

- Measure the Retracement (Wave B): Use the Fibonacci retracement tool. Draw it from the start of Wave A to the end of Wave A. Check if the subsequent price movement (Wave B) retraces to the 0.382 level. If the price finds resistance or support near this level and reverses, you have a potential Wave B.

- Project the Final Leg (Wave C): Use the Fibonacci extension tool. You will need to click on three points: the start of Wave A, the end of Wave A, and the end of Wave B. Look for the 1.272 extension level. This level is your projected target for the end of Wave C.

- Confirm the Pattern: The pattern is confirmed when the price reaches the projected 1.272 extension level for Wave C. At this point, traders expect the correction to be complete and the primary trend to resume.

Trading Strategies Using the ABC Pattern

Once you can reliably identify the ABC .328 1.27 pattern, you can build trading strategies around it. The primary strategy is to trade the resumption of the main trend after the pattern completes.

Bullish Scenario (Correction in a Primary Uptrend)

- Pattern: The market is in an uptrend. The ABC pattern is a downward correction.

- Entry: Once Wave C completes near the 1.272 Fibonacci extension level, look for signs of a bullish reversal. This could be a bullish candlestick pattern (like a hammer or engulfing candle), a divergence on an oscillator like the RSI, or a break of a short-term resistance trendline. Enter a long (buy) position once you have this confirmation.

- Stop-Loss: Place your stop-loss order just below the low of Wave C. This minimizes your risk if the primary trend fails to resume.

- Take-Profit: Set your take-profit targets based on key resistance levels or previous highs in the primary uptrend. A common first target is the high where the ABC correction began.

Bearish Scenario (Correction in a Primary Downtrend)

- Pattern: The market is in a downtrend. The ABC pattern is an upward correction.

- Entry: Once Wave C completes near the 1.272 extension level, look for signs of a bearish reversal. This could be a bearish candlestick pattern (like a shooting star or bearish engulfing), a bearish divergence, or a break of short-term support. Enter a short (sell) position upon confirmation.

- Stop-Loss: Place your stop-loss order just above the high of Wave C.

- Take-Profit: Set your take-profit targets at key support levels or previous lows in the primary downtrend. The low where the ABC correction started is a logical first target.

A Real-World Example

Imagine trading the EUR/USD pair, which has been in a strong uptrend. The price hits a peak at 1.1500 and begins to pull back.

- Wave A: The price drops from 1.1500 to 1.1400. This is a 100-pip move against the uptrend.

- Wave B: You apply a Fibonacci retracement tool from 1.1500 down to 1.1400. The price rallies back up, finds resistance near the 0.382 level at 1.1438, and turns back down. This completes Wave B.

- Wave C: You use the Fibonacci extension tool (from 1.1500 to 1.1400, then to 1.1438). The 1.272 extension level is projected at approximately 1.1311. The price continues to fall and finds support around this level, forming a bullish hammer candle.

A trader seeing this formation would enter a long position above the high of the hammer candle, place a stop-loss below the 1.1311 low, and target a return to the 1.1500 level or higher.

Essential Risk Management

No trading pattern is foolproof, including the ABC pattern. Effective risk management is crucial to protect your capital.

- Position Sizing: Never risk more than a small percentage of your trading capital on a single trade (e.g., 1-2%).

- Confirm with Indicators: Don’t rely solely on the pattern. Use other technical indicators, like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), to confirm momentum shifts.

- Wait for Confirmation: Avoid entering a trade prematurely before Wave C has clearly completed and shown signs of reversal. Patience is key.

Your Next Steps in Pattern Trading

The ABC .328 1.27 pattern is a valuable tool for any technical trader. It provides a structured way to identify market corrections and pinpoint high-probability entry points for trading with the dominant trend. By combining the pattern with Fibonacci ratios, you create a quantifiable and repeatable trading setup.

Like any strategy, mastery comes with practice. Spend time on historical charts identifying these patterns and practice trading them in a demo account before risking real money. By doing so, you can build the confidence and skill needed to effectively incorporate this pattern into your trading arsenal.

Frequently Asked Questions

What is the difference between an ABC pattern and a 123 pattern?

While they look similar, an ABC pattern is a corrective pattern against the main trend, whereas a 123 pattern often signals a reversal of the main trend. The ABC pattern implies the original trend will continue, while the 123 pattern suggests it is ending.

Can this pattern be used on any timeframe?

Yes, the ABC pattern is a fractal pattern, meaning it appears on all timeframes, from 1-minute charts to weekly charts. However, patterns on higher timeframes are generally considered more reliable.

What if Wave B goes past the 0.382 level?

If Wave B retraces significantly more or less than 38.2%, it is no longer the specific “.328” variation of the ABC pattern. It might still be a valid ABC correction, but you would need to adjust your expectations and look for other common Fibonacci retracement levels, such as 0.500 or 0.618.

Why is it called .328 instead of 0.382?

In some trading communities and educational materials, the 0.382 Fibonacci level is colloquially referred to as .328. While 0.382 is the mathematically correct Fibonacci ratio, both terms refer to the same key retracement level.